AI Insights from the Dotcom Bubble That Captivate Me

Will AI follow the trajectory of the dot-com bubble?

During the late 1990s, I served as the lead digital consultant for prominent UK enterprises, including Diageo, amidst the dot-com bubble. My role involved guiding companies in harnessing the potential of the web and identifying valuable opportunities during such a turbulent time in the tech industry. It was an enthralling era characterised by relentless speed, and volatility as tech companies soared and crashed like corks in stormy waters.

Now, twenty-four years later, I am again captivated by the growing excitement surrounding artificial intelligence. Will AI follow the trajectory of the dot-com bubble, potentially leading to another overinflated sector headed for a crash? Below are some insights I have gained from my observations.

Parallels between AI and the dot com bubble

I have noticed striking similarities between these two industries. Both experienced a surge in funding within a short period. I vividly recall assisting dot-com startups in securing investments from angel investors during that prosperous time. Similarly, investors now pour money into AI-focused companies and technologies, eagerly seeking the next groundbreaking opportunity.

However, it is essential to highlight a key distinction: While many dotcom-era companies went public to raise capital, AI investments primarily come from the private sector and tech giants, making AI less risky and more sustainable.

Both industries have also witnessed the rapid emergence and adoption of transformative technologies. From search engines and web-based shopping in the dot-com era to the rise of AI algorithms today, the pace of innovation has been remarkable.

Exploring the Distinction: AI versus the Dot Com Bubble

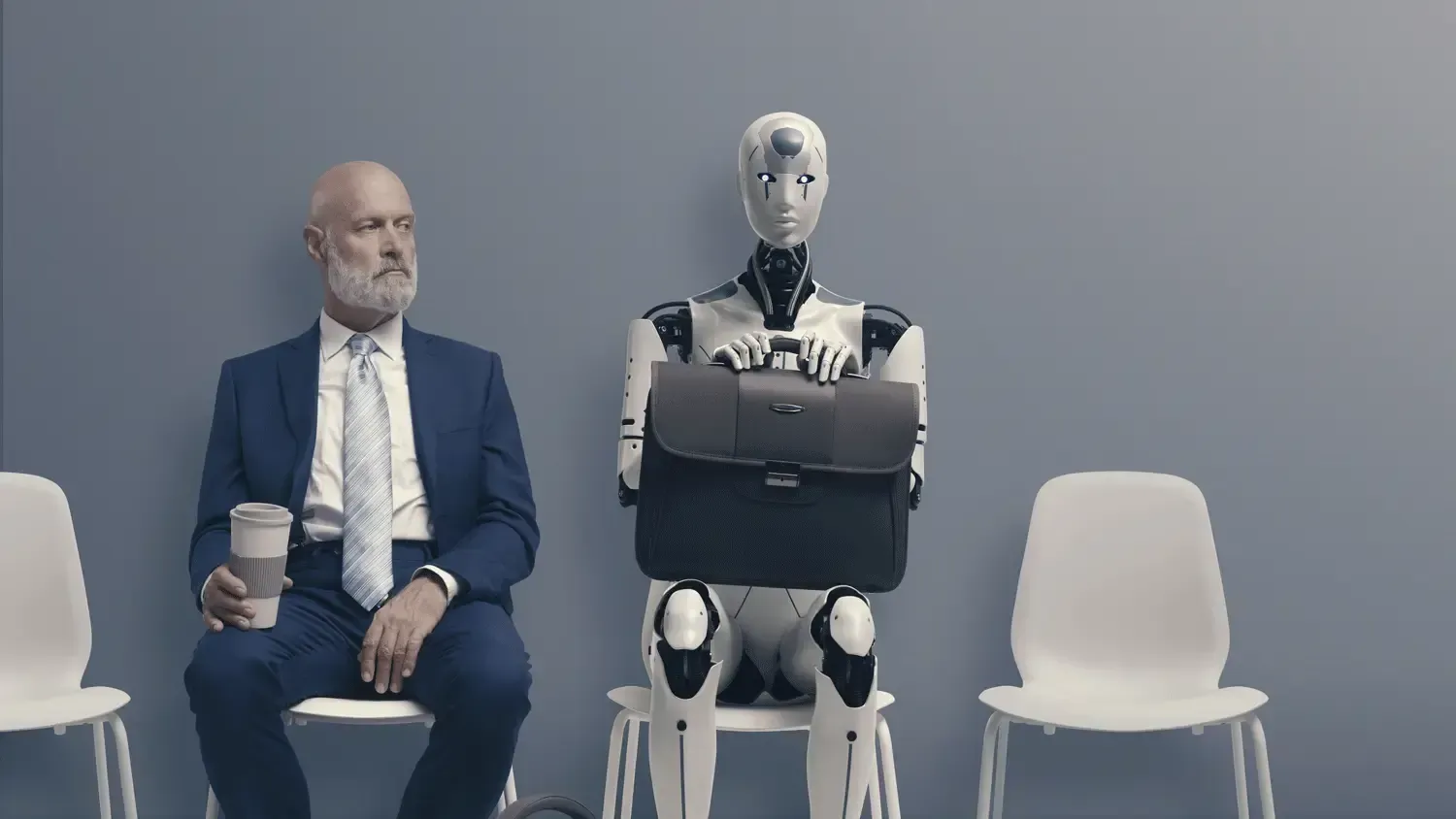

AI differs from the dotcom era due to its diverse applications and profound impacts across sectors such as healthcare, automotive, military, and finance. This extensive potential strengthens the argument for AI's resilience.

Furthermore, investments in AI focus on tangible advancements and proof of concept rather than relying solely on hype. This evidence-based approach increases the likelihood of success. With a culture of continuous innovation and experimentation, AI thrives as a rapidly evolving field.

Lastly, leading tech companies such as

Google, Microsoft, Meta,

OpenAI, and X (formerly Twitter) are making significant investments in AI, foreseeing substantial returns. This level of commitment from industry giants is more pronounced than during the dot-com boom. Ironically, this race for AI supremacy ensures the seamless integration of AI into our lives and business systems, guaranteeing long-term success.

Beware of the Artificial Sizzle

Similar to the hype of the dot-com boom, it is crucial to remember that new technologies, such as AI, come with risks and benefits. The pitfalls of adopting AI technology too quickly are amplified when:

- There is excessive market hype surrounding the capabilities of the technology.

- Tech vendors engage in a race for market dominance, selling sizzle and rushing products and services that are still in beta.

- Companies succumb to the influence of hype, prioritising it over strategic decision-making or, even worse, opting for indecisiveness.

Incorporate the Power of AI into Your Business Strategy

Undoubtedly, AI is poised to transform businesses. However, companies must thoroughly review their overall business, operational, and data strategies before exploring how AI technologies can drive improvements across their value chain.

It is crucial to avoid reacting tactically and instead take a strategic approach.

For example, let's explore the development of chatbots using

Generative (GenAI) technology. The market is buzzing with excitement as businesses increasingly seek to leverage chatbots to enhance customer experience, boost sales, and reduce staffing requirements. However, implementing a successful chatbot strategy necessitates a robust data architecture and comprehensive chatbot training using external data sources, which may have intellectual property limitations. The implications of introducing a poorly designed chatbot experience can be significant from a strategic standpoint.

Careful consideration of AI-related decision-making, rather than hasty reactions, is essential. By adopting a

strategic approach, businesses can ensure sustained success with AI while mitigating risks.

AI BLOG